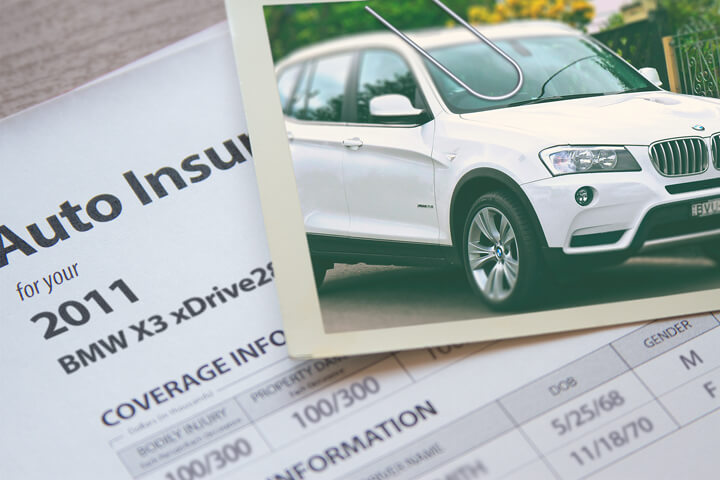

BMW X3 insurance image courtesy of QuoteInspector.com

Want to know how to find more competitive BMW X3 insurance in San Diego? Comparison shopping for cheaper BMW X3 insurance in San Diego is always frustrating for drivers who are beginners to online rate comparisons. With so many agents and companies competing online, it can be a difficult situation to find the perfect company for you.

A recent NerdWallet.com study revealed that most consumers kept buying from the same company for at least four years, and practically 40% of insurance customers have never quoted rates to find cheap coverage. California insurance shoppers could cut their rates by as much as $469 a year by just comparing quotes, but they think it's difficult to compare rate quotes.

A recent NerdWallet.com study revealed that most consumers kept buying from the same company for at least four years, and practically 40% of insurance customers have never quoted rates to find cheap coverage. California insurance shoppers could cut their rates by as much as $469 a year by just comparing quotes, but they think it's difficult to compare rate quotes.

You should make it a habit to compare premium rates on a regular basis because rates change regularly. Just because you had the best rate on BMW X3 insurance in San Diego a couple years back there may be better deals available now. Block out anything you think you know about insurance because we're going to demonstrate one of the best ways to properly buy coverages while reducing your premium.

If you currently have a car insurance policy, you will definitely be able to buy cheaper insurance using the ideas presented in this article. Buying the lowest cost insurance coverage in San Diego is easy to do. But California drivers benefit from understanding how companies price insurance differently and use it to find better rates.

The quickest method we recommend to compare rates for BMW X3 insurance in San Diego is to know most insurance companies actually pay money for the chance to compare their rates. The one thing you need to do is give them some information including the year, make and model of vehicles, how old drivers are, if you lease or own, and how you use your vehicles. Those rating factors is submitted instantly to insurance companies and you receive quotes with very little delay.

To check car insurance prices now, click here and enter your coverage details.

The following companies are ready to provide quotes in California. If multiple companies are shown, we recommend you get price quotes from several of them to get the most competitive price.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X3 3.0I xDrive AWD 4-Dr | $468 | $1072 | $534 | $32 | $160 | $2,266 | $189 |

| Get Your Own Custom Quote Go | |||||||

Data variables include single male driver age 40, no speeding tickets, no at-fault accidents, $100 deductibles, and California minimum liability limits. Discounts applied include homeowner, multi-vehicle, multi-policy, claim-free, and safe-driver. Estimates do not factor in garaging location in San Diego which can modify price quotes substantially.

Impact of speeding/accidents on auto insurance rates

The illustration below illustrates how violations and at-fault accidents increase BMW X3 insurance prices for different age groups of insureds. The rates are based on a married male driver, full physical damage coverage, $250 deductibles, and no other discounts are factored in.

Buying the right vehicle insurance in California is an important decision

Despite the high insurance cost for a BMW X3 in San Diego, car insurance is required in California but it also protects you in many ways.

First, most states have minimum mandated liability insurance limits which means you are required to carry a minimum amount of liability protection in order to get the vehicle licensed. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

Second, if you have a lien on your vehicle, it's guaranteed your bank will stipulate that you buy full coverage to ensure loan repayment if the vehicle is totalled. If coverage lapses or is canceled, the bank may insure your BMW at a much higher rate and make you pay the higher premium.

Third, car insurance preserves not only your vehicle but also your assets. It will also cover hospital and medical expenses for yourself as well as anyone injured by you. As part of your policy, liability insurance will also pay attorney fees if you cause an accident and are sued. If you receive damage to your vehicle caused by a storm or accident, collision and comprehensive (also known as other-than-collision) coverage will pay to have it repaired.

The benefits of buying car insurance more than offset the price you pay, particularly if you ever have a claim. In a recent study of 1,000 drivers, the average customer is wasting up to $750 every year so we recommend shopping around at least once a year to help ensure money is not being wasted.

BMW X3 Insurance Cost Factors

Lots of things are used when you quote your car insurance policy. Some are pretty understandable such as traffic violations, but other factors are not quite as obvious such as your credit history or how safe your car is. An important part of buying insurance is that you know the different types of things that are used to determine the level of your policy premiums. If you know what positively or negatively impacts your premiums, this enables you to make decisions that may reward you with better car insurance rates.

Your liability protection limits - A critical coverage on your policy, liability insurance will provide protection in the event that you are found liable for personal injury or accident damage. This coverage provides legal defense to defend your case. It is affordable coverage compared to insuring for physical damage coverage, so drivers should carry high limits.

The type of vehicle you drive affects your costs - The performance of the vehicle you are trying to find cheaper insurance for makes a substantial difference in how high your rates are. The cheapest insurance rates are for the lowest performance passenger cars, but many other things help determine your insurance rates. Because the BMW X3 is a luxury crossover, insuring your vehicle will cost substantially more than the average rate where you live in San Diego.

Marriage equates to better costs - Having a significant other may earn you lower rates on your car insurance bill. Marriage is viewed as being more mature than a single person and insurance companies like that being married results in fewer claims.

Discounts for auto and home policies - Most larger insurance companies provide better rates for people who buy several policies from them. It's known as a multi-policy discount. Discounts can amount to anywhere from five to ten percent in most cases. Even with this discount applied, it's always a smart idea to comparison shop to verify if the discount is saving money. You may still save money by insuring with multiple companies.

Job can influence prices - Did you know your car insurance rates can be affected by your occupation? Careers like military generals, airline pilots, and medical professionals have higher rates than average because of intense work situations and extremely grueling work hours. On the other hand, jobs such as professors, students and homemakers have the lowest average rates.

How do annual miles impact costs? - The more you drive your BMW every year the higher the price you pay to insure it. Most insurance companies charge rates based on how the vehicle is used. Cars and trucks that do not get driven very much qualify for better rates than cars that get driven a lot. It's always a good idea to double check that your car insurance declarations sheet correctly shows the correct usage. An incorrectly rated X3 can result in significantly higher rates.

A good credit history can save money - Having a bad credit score is a big factor in calculating your car insurance rates. If your credit can use some improvement, you could pay less to insure your BMW X3 by improving your rating. Insureds with high credit ratings tend to be more responsible as compared to drivers with bad credit.

Cars with good safety ratings cost less to insure - Cars with high safety ratings can get you lower premiums. Safer cars result in less severe injuries and any reduction in injury severity translates into fewer and smaller insurance claims and thus lower rates.

BMW X3 historical loss data - Auto insurance companies use data from past claims when they file their rates in each state. Vehicles that the data shows to have higher frequency or amount of claims will have higher rates for specific coverages. The table below demonstrates the insurance loss data for BMW X3 vehicles.

For each coverage category, the claim amount for all vehicles combined as an average is considered to be 100. Numbers below 100 suggest a positive loss record, while numbers above 100 indicate higher probability of having a loss or a tendency for losses to be larger than average.

Insurance Loss Ratings for BMW X3 Vehicles

| Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| BMW X3 4dr 2WD | 122 | 99 | ||||

| BMW X3 4dr 4WD | 109 | 93 | 117 | 69 | 64 | 76 |

Empty fields indicate not enough data collected

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Discounts can help save money on BMW X3 insurance in San Diego

Some providers don't always advertise every policy discount in a way that's easy to find, so the following is a list of some of the best known as well as some of the hidden credits that you can use to lower your rates.

- Safety Course Discount - Passing a course teaching driver safety skills can save you 5% or more and make you a better driver.

- Multi-policy Discount - If you combine your home and auto policies and place coverage with the same company you may earn over 10 percent off each policy depending on the company.

- Sign Early and Save - A few larger companies offer discounts for buying a policy early. The savings is around 10%.

- Accident Forgiveness - This one isn't a discount, but a few companies such as GEICO, Allstate and Liberty Mutual permit an accident before raising your premiums with the catch being you have to be claim-free for a set time period.

- Anti-lock Brake Discount - Cars, trucks, and SUVs with ABS and/or traction control are safer to drive so companies give up to a 10% discount.

- Distant College Student Discount - College-age children who are attending college and don't have a car may be insured at a cheaper rate.

- Professional Organizations - Participating in a civic or occupational organization in San Diego can get you a small discount when shopping for insurance.

- Federal Employees - Active or former government employment can earn a discount up to 10% with a few insurance companies.

- Telematics Data - Drivers who elect to allow companies to scrutinize driving manner by installing a telematics device such as Snapshot from Progressive or Drivewise from Allstate may get a rate reduction if they have good driving habits.

As is typical with insurance, most discounts do not apply to the whole policy. Most cut the cost of specific coverages such as comprehensive or collision. So despite the fact that it appears all those discounts means the company will pay you, companies wouldn't make money that way.

Large insurance companies and some of their more popular discounts include:

- AAA offers premium reductions for multi-policy, education and occupation, pay-in-full, AAA membership discount, and good student.

- Progressive includes discounts for online signing, homeowner, online quote discount, multi-policy, and good student.

- State Farm may have discounts that include good student, defensive driving training, multiple policy, Drive Safe & Save, and multiple autos.

- Esurance may include discounts for online quote, good student, Pac-12 alumni, emergency road assistance, and anti-theft.

- Nationwide offers discounts including easy pay, business or organization, defensive driving, good student, and multi-policy.

Before buying, ask every prospective company which discounts you qualify for. Some of the discounts discussed earlier might not be offered in San Diego. To locate insurance companies with the best discounts in California, follow this link.

Can't I compare prices from local San Diego insurance agents?

Certain consumers prefer to sit down with an agent and that can be a smart move One of the best bonuses of getting free rate quotes online is that you can find lower rates and still have a local agent.

After filling out this quick form, the quote information gets sent to participating agents in San Diego who will gladly provide quotes and help you find cheaper coverage. You won't even need to search for an agent as quotes are delivered to you instantly. You can get cheaper car insurance rates and a licensed agent to talk to. If for some reason you want to quote rates from a specific car insurance provider, don't hesitate to find their quoting web page and submit a quote form there.

After filling out this quick form, the quote information gets sent to participating agents in San Diego who will gladly provide quotes and help you find cheaper coverage. You won't even need to search for an agent as quotes are delivered to you instantly. You can get cheaper car insurance rates and a licensed agent to talk to. If for some reason you want to quote rates from a specific car insurance provider, don't hesitate to find their quoting web page and submit a quote form there.

Finding the right company requires you to look at more than just the bottom line cost. Before buying a policy in San Diego, get answers to these questions.

- Do they get extra compensation for selling add-on coverages?

- Do they offer accident forgiveness?

- Which insurance companies are they affiliated with?

- Is vehicle mileage a factor when determining depreciation for repairs?

- How much will you save each year by using a higher deductible?

- Are they able to influence company decisions when a claim is filed?

When finding a local San Diego insurance agent, there are a couple of different types of agencies and how they operate. Car insurance agents in San Diego can be categorized as either independent or exclusive.

Exclusive Car Insurance Agents

Agents that elect to be exclusive have only one company to place business with such as Farmers Insurance, American Family, State Farm and Allstate. These agents are unable to place coverage with different providers so it's a take it or leave it situation. Exclusive insurance agents receive extensive training on sales techniques which can be an advantage. Consumers frequently use the same exclusive agent mainly due to the brand name rather than low rates.

Shown below is a short list of exclusive agencies in San Diego that are able to give comparison quotes.

- Mike Moore - State Farm Insurance Agent

12880 Rancho Penasquitos Blvd d - San Diego, CA 92129 - (858) 484-1297 - View Map - Kevin Kane - State Farm Insurance Agent

3914 Murphy Canyon Rd a252 - San Diego, CA 92123 - (858) 514-0385 - View Map - David Hiser - State Farm Insurance Agent

910 Grand Ave #205 - San Diego, CA 92109 - (858) 272-2343 - View Map

Independent Insurance Agents

Agents that choose to be independent are not employed by one company and that is an advantage because they can write policies with a variety of different insurance companies and find you cheaper rates. If prices rise, your policy is moved internally which makes it simple for you. When comparison shopping, it's recommended you get quotes from a couple of independent agencies to get the most accurate price comparison. They also have the ability to place coverage with smaller mutual companies which can save you money.

Below are independent agents in San Diego that can give you rate quotes.

- Nationwide Insurance: Keith Jackson Insurance Agency Inc

1081 Camino del Rio S Ste 210 - San Diego, CA 92108 - (916) 742-6995 - View Map - Nickie Heath Insurance Agency

16855 W Bernardo Dr # 230 - San Diego, CA 92127 - (858) 487-3737 - View Map - Leavitt Insurance Agency of San Diego

380 Stevens Ave - Solana Beach, CA 92075 - (858) 259-5800 - View Map

Persistence is the key to cheap rates

Drivers switch companies for a number of reasons such as policy cancellation, being labeled a high risk driver, policy non-renewal or even not issuing a premium refund. No matter why you want to switch, finding a great new company is less work than it seems.

As you go through the steps to switch your coverage, it's a bad idea to buy lower coverage limits just to save a few bucks. There are a lot of situations where someone dropped collision coverage and learned later that the small savings ended up costing them much more. Your goal should be to buy the best coverage you can find at the best possible price while not skimping on critical coverages.

You just read many ideas to lower your BMW X3 insurance car insurance rates in San Diego. The most important thing to understand is the more you quote San Diego car insurance, the better your comparison will be. You may even be surprised to find that the lowest car insurance rates are with the smaller companies.

Additional auto insurance information is available on the following sites:

- Information for Teen Drivers (GEICO)

- Safety Tips for Teen Drivers (Insurance Information Institute)

- How to Avoid Staged Accidents (State Farm)